by Deborah Grieb, Director of Marketing and Consumer Insights; Ed Kim, President and Chief Analyst

Over half of new vehicle intenders who aren’t already intending to purchase an electric vehicle (EV) say they would consider purchasing one in the near future, according to AutoPacific’s most recent EV Consumer Insights Study. The finding is part of a large study designed to help the automotive industry navigate through the vast consumer sentiment regarding EVs. We know widespread adoption of EVs in the U.S. is a huge challenge. One of our goals with this study, and much of our syndicated study work, is to focus on the future and to understand the potential for turning EV rejectors into acceptors.”

With 58% of consumers who are in the market for a new vehicle within the next 3 years being willing to consider at EV, the challenge becomes finding an EV path for the remaining 42% who say they won’t consider an EV. The study confirms many known obstacles to EV adoption, including concerns about range, charge times and charger availability, to name a few, yet also sheds light on EV cost. 36% of EV rejectors say the cost of buying and/or operating at EV is too expensive. When asked a follow-up question regarding a price point that would change their mind and get them to consider an EV, nearly half of respondents (47%) indicated a price under $35,000 would change their mind. EVs are known to be expensive, luxury-type vehicles, so many consumers looking for a $25,000-$35,000 vehicle simply don’t even have one as an option.

Could New Lower-Priced EVs Help Propel Sales Growth?

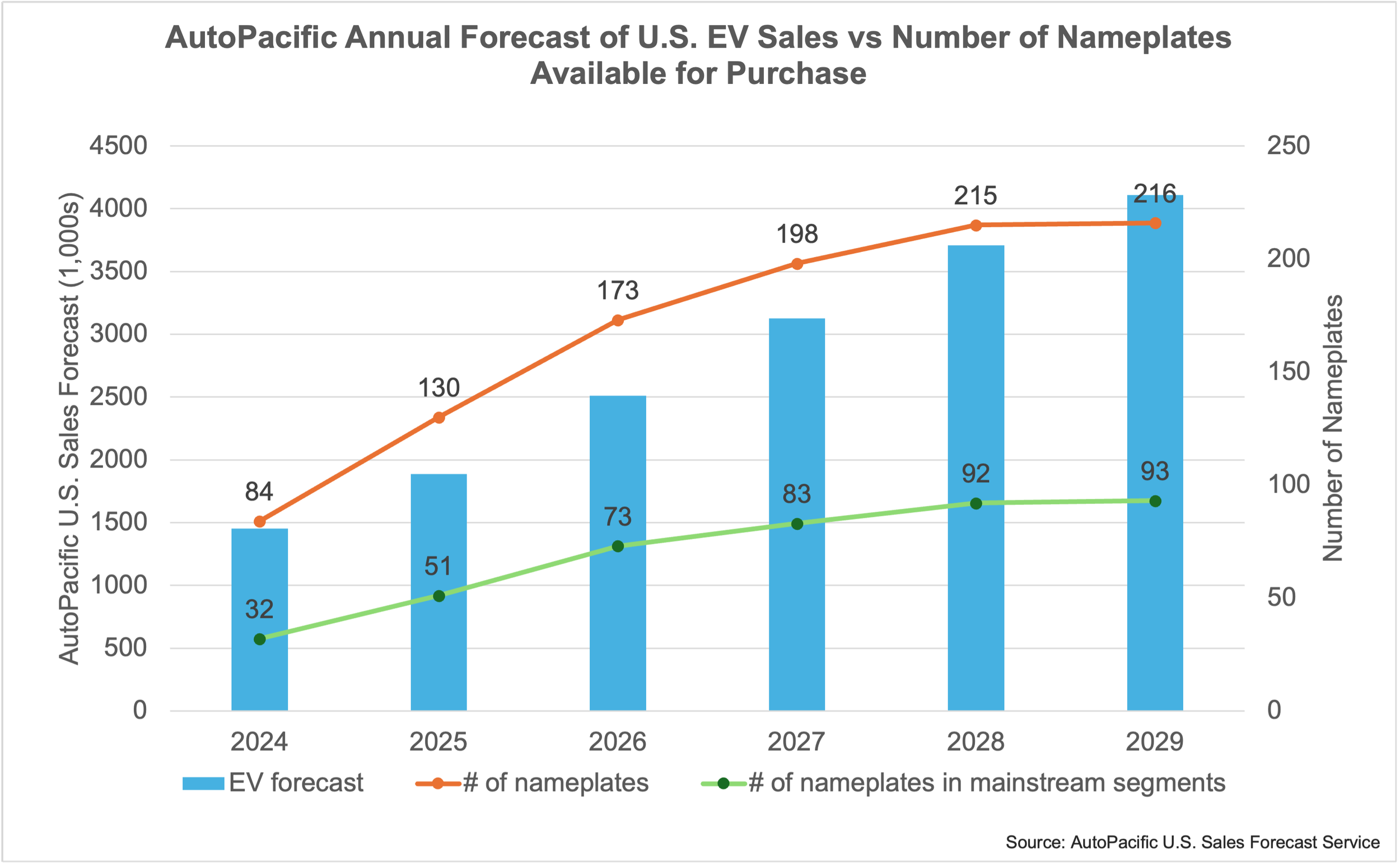

According to our latest U.S. Sales Forecast, sales of EVs will reach 1.4 million units by the end of 2024, accounting for 9.1% of total light vehicle sales. Yet the real growth happens between 2026 and 2029 when EV sales are forecast to grow from 2.5 million units, 15% of total sales, to 4.1 million units, 25% of total sales. The next couple of years are likely to see moderate growth of EV sales in the U.S. as the infrastructure advances and consumer trust grows. Then, an influx of new, lower-priced EVs that fall into various segments will enter the market, vastly expanding consumer range and interest. Currently, the EV product mix in the U.S. market is lopsided towards luxury-priced EVs, and that needs to change for widespread EV adoption to take place.

While affordable EVs are necessary for continued EV adoption growth, it’s just as important for these models to possess the size, format, and features that American consumers want. EVs taking the format of subcompact five-door hatchbacks have already been proven unpopular with American shoppers. Appealing crossover SUV designs with enough size and space will be key to mainstream EV adoption.

AutoPacific has been forecasting U.S. light vehicle sales for over thirty years and is relied upon by auto manufacturers and suppliers worldwide. Average forecast accuracy over the last five years, measured from Q1 TLV annual forecast to actual TLV annual sales for the same year, is 95%, including the unexpected pandemic years.